Tuesday, May 11, 2010

Crack Shack vs. Mansion

CRACK SHACK VS. MANSION

Monday, May 10, 2010

April Market Watch

No matter how much the media tries to blow up the situation, the numbers are showing that the there is no bubble to burst, just a return to a more balanced market with greater inventory and movement.

There is no doubt that things will slow down in the latter half of 2010 but not the frightening cliff dive that the papers would have you believe, at least not in Toronto.

Again, caution to buyers who are shopping in the frenzy of multiple offers. I have pulled back many of my buyers from over-paying for properties.

We have a saying in our business that "someone just got buried" when we hear of multiples resulting in a price way over value.

Meaning, they won't be able to sell it for close the amount they paid if the market slows down even a touch and they won't see the typical gains in equity and value if the market rises. Net, net - they'll never get out of it...at least for a long time.

Not to mentioned the previously discussed major issue of not having the house appraise out.

The other saying is that "a home is worth what the market is willing to pay". I disagree.

Just because someone got silly and overpaid does not mean that is what the home is worth. They were just able to take advantage of buyers caught up in the frenzy, or buyers not doing their homework on the home's actual value.

The value proposition of a home is based on a careful evaluation of comparable properties that have sold in the same area in a recent period of time, i.e. 0-12 months, depending on the market conditions.

Do your home work and be patient - the right home will come :)

Cheers,

Mark

May 5, 2010 -- Greater Toronto REALTORS® reported 10,898 sales through the Multiple Listing Service® (MLS®) in April, representing a 34 per cent increase compared to April 2009. There were also 20,683 new listings in April – a 59 per cent annual increase. Both the sales and new listings results amounted to new records for the month of April under the current Toronto Real Estate Board (TREB) boundaries.

“The GTA resale market is functioning properly. Sales were high as buyers continued to take advantage of affordable home ownership opportunities. Listings grew as home owners reacted to strong sales and price growth,” said Toronto Real Estate Board President Tom Lebour. “More balanced market conditions will result in sustainable rates of annual price growth in the second half of 2010.”

The average price for April transactions was $437,600 – up 13 per cent compared to the average of $385,641 recorded in April 2009.

“Home sales continue to be driven by many different segments of the market, with sales growth for all major home types in both the City of Toronto and surrounding 905 regions,” said Jason Mercer, TREB’s Senior Manager of Market Analysis. “Home sales will remain strong in the second half of 2010, but will slip from the current record pace as borrowing costs rise.”

Mortgages - Rate Creep?

From the desk of Peter Majthenyi and Andre Semeniuk...

Lately there's been a lot of speculation on when and how high interest rates will go. I don't think any of us thought rates would stay low forever.

I am confident we all recognize that our economy will gradually improve, and along with economic growth comes more realistic mortgage rates, likely in the range of 4-6%, which are still historically amazing.

A better question is "When do we feel they will start to rise?" To date, interest rates have not gone up, yet the lenders have increased their margins on 4 and 5 year fixed terms to take some early profits in expectation rates will begin rising in the near future.

Recently, CMHC (Canada Mortgage and Housing Corp) released their annual analysis that clearly indicates that any interest rate increases will need to be "controlled increases", or in other words gradual increases to avoid any economic shock.

Meanwhile in the US, their economic recovery is very fragile and being undermined by high unemployment. The US Federal Reserve is predicting further declines in home prices and therefore are not expected to increase their interest rates until 2012.

Many studies (see CMHC.ca) have also identified that there is no real estate "bubble" and conversely we are approaching "equilibrium", meaning that supply and demand are coming in line, which will result in more stable home prices.

To complement this data, the results from a recent survey indicated that more than 80% of Canadians were not concerned if their mortgage rate increased by 2-3%. The media tends to make rate increases sound worrisome, but if one takes the time to "pause" and do some simple math it's easy to understand the sky is not falling.

For example, many consumers choose variable mortgages because the Government would have to raise the overnight rate 18 times and it still performs the same as jumping into a 5 year fixed term immediately.

Variable mortgages are not about rates rising, they are about accepting rates will rise and deciding if I want to pay the higher rate now or later, and you guessed it… most would much rather pay a higher rate later. Who would be in a rush to pay 4-5% this year, when they can put that off for another 3-5 years?

Speaking about variable rates. Currently the typical variable rate is Bank Prime less .5% or 1.75%, yet we understand this is not sustainable much longer. In the coming months, we are expecting lenders to price variable mortgages at Bank Prime less .25% or 2%… so take advantage of the maximum discounts right away.

Borrowers that secured a variable in the last year or so that are paying Prime Plus .25% or greater should strongly consider paying their small discharge penalty and changing to a Prime less .5% mortgage immediately… the math definitely works in the borrowers favour!

We are expecting a healthy economy for the rest of 2010 yet less growth is expected for 2011, but at least the worst is behind us. Let's hope our unemployment comes down while our consumer confidence goes up!

To ensure you, or someone you know, has the right "Mortgage Plan" & "Investment Plan" please feel free to reach out to us anytime.

I will share more with you soon… Peter, Andre & Team

Monday, April 19, 2010

Lose the clutter. Find the cure.

How do you turn this...

Into this?

With this...

Imagine...fondue sets and velour leisure suits actually have the power to cure cancer!

On Saturday, May 29th, RE/MAX is sponsoring the Yard Sale for the Cure.

Join us in our fight against breast cancer by holding a yard sale or by shopping for bargains.

Register online to hold your own yard sale at www.yardsaleforthecure.com to get a Yard Sale for the Cure kit for only $25.00 which includes a lawn sale sign, hat, posters, pink balloons and info package.

100% of the funds donated will support breast cancer research and patient care.

Spring shopping fever!

Here are our favorite sources for furniture and accessories, as well as some of the hottest products for the season. Check out the links below for great floor sales.

Design Within Reach

435 King Street West

mscott@dwr.com

416.977.4003

www.dwr.com

Great for indoor living as well, this west end store has an incredible selection and a great 7-10 day turnaround for stock. Prices are officially listed in USD on their website but they said they are at par right now with the Canadian dollar so now is the time to buy!

Some of our favorite things...

Looking for a solution for ambient lighting? Check out these soothing planters. On sale from $525 to $446 USD

Looking for a solution for ambient lighting? Check out these soothing planters. On sale from $525 to $446 USD

Finally, house numbers that have some style!

$48 USD each.

Sick of lighting candles and wax dripping all over your outdoor furniture as the wind blows them out? Set up these gas table-top torches as shown in a cluster or purchase a series in the same size and arrange in a line down the center of your table. $90-230 USD

Our contact at Design Within Reach, Molly Scott has also sent us their floor sale details for incredible discounts. Click below for full details - stock subject to availability so give Molly a call if you see something you like.

Design Within Reach Floor Sale

Southport Home

6201 Highway 7, Vaughn

905.850.9995

www.southporthome.ca

We got our own patio furniture there last year and love it. Great value, quick turnaround for cushions as they have their cushions done in-house and they don't charge extra for having zippers on them. Not to mention the cushions are far more comfortable than most of the more expensive suppliers.

Stack Canada

2124 Queen Street East

(416) 693-6868

http://www.stackcanada.com/

Located at Hammersmith and Queen, this new store is a great place for housewarming or hostess gifts, and all those accessories that you seem to need to organize the house. They also have some incredibly fun and indulgent items too.

Amazing for durablity and style, they carry Chilewich floor mats in a variety of sizes.

Wednesday, April 7, 2010

Inside the Toronto Real Estate Market

The spring market is definitely in full swing!

The great weather has meant a nice kick start to 2010 and buyers are coming out in droves. With that, sellers are now wanting to take advantage and we are seeing a large jump in the number of listings coming out.

My hope is that the market does not become too flooded with inventory as that will once again cause an imbalance and depress values. The danger will be sellers who see the activity in the market and become overconfident, and over price their homes.

It is extremely important to continually evaluate competitive listings that are coming out so that the listing price of your home is a reflection of the current market. You have to treat your home like any other product in the market place. If a buyer can get more for less with another home that meets their criteria, they will. Vice versa, if your home offers more, you can ask for more.

A caution to buyers as well....do not get caught up in the bidding wars that are sparking once again. I always counsel my clients to determine the number they are comfortable with, based on the value of the home, not the frenzy and emotion of the bidding situation.

But go in with your best offer - ask yourself, if you heard that the home sold for $5,000 more, would you have felt good about that price yourself? Know your limit and understand your financial situation. If you pay too much for a home, the bank may not appraise it out at your purchase price and you will be left to make up the difference on top of your down payment.

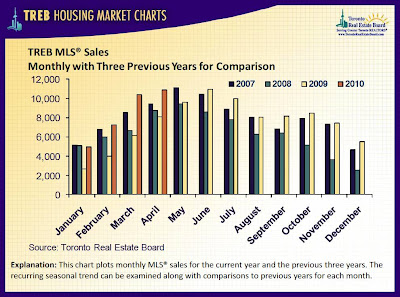

Check out the Toronto Real Estate Board Housing Charts and the full Market Watch below..

Cheers,

Mark

Toronto Real Estate Housing Charts

Check out the March and first quarter Market Watch from the Toronto Real Estate Board...

Check out the March and first quarter Market Watch from the Toronto Real Estate Board...

Record First Quarter Sales

April 6, 2010 -- Greater Toronto REALTORS® reported 10,430 sales through the Multiple Listing Service® (MLS®) in March, pushing total first quarter 2010 sales to 22,418 – the best result on record under the current Toronto Real Estate Board (TREB) boundaries. The average price for March transactions was $434,696. The average price for the first quarter was $427,948.

“The strong rebound in the existing home market was one of the initial drivers of economic recovery,” said TREB President Tom Lebour. “While we don’t expect to see the same rates growth moving forward, GTA households will remain confident in ownership housing as a quality long-term investment, especially as economic recovery expands across all industries.”

The annual rate of growth for new listings continued to accelerate in March. The number of new listings grew by 42 per cent compared to March of 2008.

“The average home price in the GTA will continue to grow this year, but the pace will slow as we move through the spring,” said Jason Mercer, TREB’s Senior Manager of Market Analysis. “As growth in new listings starts to outstrip growth in sales, buyers will experience more choice, resulting in more sustainable single digit rates of average price growth.”

For the full Toronto Real Estate Board Market Watch, click here.

Tuesday, April 6, 2010

Mortgages - Rate Hikes in our Future?

You've probably heard the buzz on mortgage rates going up - check out this article by Rob Carrick of the Globe and Mail for a very important date...

The end is nigh for low-interest-rate heaven.

Rob Carrick, March 30th - Globe & MailWith rates on the rise, here's what you need to know if you don't want to add years to your variable-rate mortgage...

Mark June 1 on your calendar if you have a variable-rate mortgage.

If you have a 35-year amortization and put down only 5 per cent when you bought your home, then be extra diligent about noting this date. Let things slide and you might be amazed at how much longer it takes to pay off your mortgage.

With the economy showing signs of rebounding, there's growing speculation that June 1 will be the day the Bank of Canada begins the coming cycle of interest-rate increases. Whenever this happens, it's back to the real world for variable-rate mortgage holders after almost three years in low-interest-rate heaven.

If you have a fixed-rate mortgage, you're immune to rate increases until renewal time. (Note that Royal Bank, Toronto-Dominion Bank and Laurentian Bank said they would raise their rates on five-year, closed, fixed-rate mortgages effective today.) With a variable-rate mortgage, however, your rate is adjusted up or down with each movement in the prime lending rate. The prime is influenced by the Bank of Canada's overnight rate, which will be set eight times in 2010. The next rate announcement is scheduled for April 20, and the ones after that happen June 1, July 20 and Sept. 8.

If you have a variable-rate mortgage but you don't have a plan, you're going to live and die by these dates.

Let's assume that you don't intend to use the provision that allows a variable-rate mortgage to be converted into a fixed-rate loan without penalty. Variable-rate mortgages usually cost you less interest over the long term, so this decision is certainly defensible.

A first step in preparing for higher rates is to ask your lender what will happen to your mortgage payments when the prime rate starts to increase.

Vince Gaetano, a mortgage broker and vice-president at MonsterMortgage.ca, mentioned two possibilities. The first is that your lender will adjust your payments higher to cover the increased interest costs and stay within the amortization period you selected when you arranged the mortgage. If your mortgage works this way, all you have to do to prepare for higher rates is clear some room for higher payments.

The second possible result of higher rates is that nothing will happen to your payments. In other words, you're on your own. "The lender won't do anything until negative amortization kicks in," Mr. Gaetano said.

Negative amortization means your payments aren't enough to cover the interest you owe. Whatever extra interest there is gets tacked onto your principal, thereby increasing both what you owe and the payback period for the mortgage.

Even without negative amortization occurring, you can still add years to the payback period. Mortgage broker Jake Abramowicz ran some projections and found that an extra 10 years or more is possible.

There's extra urgency here if you have a 35-year amortization and you made the minimum 5-per-cent down payment. If rates rise substantially and you don't increase your payments, you could be knocking off just a few dollars of principal every payment. "People might as well be paying rent," Mr. Abramowicz said.

There's a third group of variable-rate mortgage holders out there - those who had their payments pegged to the rate of a three-year fixed mortgage. Note: Lenders have traditionally made sure you could afford the higher three-year rate before selling you a variable-rate mortgage. Starting April 19, they'll have to use the posted Big Bank five-year rate.

If you've been making higher-than-needed payments on a variable-rate mortgage, then you've done yourself a huge favour in terms of chipping away at your principal. Just remember that unless you keep tabs on rates, a sustained rise in borrowing costs could remove your cushion and slow your repayment process down.

The simple solution is to bump up your payments to cover off the extra interest cost. Typically, you can increase your regular payments by up to 100 per cent in a year. If you want to pay even more, try a lump sum or use the double-up payments that some lenders allow you to make when it suits you (it's not necessary to pay exactly double your normal payment, by the way).

Mr. Gaetano said that even if the payments on your variable-rate mortgage remain unchanged as rates rise, you'll still receive notices from your lender each time the prime rate rises. This ain't junk mail, people: It's a warning you could slowly be falling behind in getting your mortgage paid off.

Want to avoid the hassle of rate watching? There's always the option of switching to a fixed-rate mortgage. Mr. Abramowicz's take on this idea: "It's never a bad idea to lock in under 4 per cent [for five years]." Rates are going up, so hurry.